Introduction

Have you ever noticed how often copper quietly shows up in conversations about the economy—right next to oil, gold, or inflation? That’s not by accident. The copper price is one of those rare indicators that speaks to everyday life and global economics at the same time. When copper prices rise or fall, they’re telling a story about construction activity, manufacturing demand, energy transitions, and even how confident businesses feel about the future.

If you’ve ever searched for copper price because you’re investing, trading, running a business, studying economics, or just trying to make sense of headlines, you’re in the right place. This guide is designed to feel like a conversation with someone who’s been watching commodity markets for years—not a textbook or a robotic explainer.

By the end of this article, you’ll understand what the copper price really means, what drives it up or down, how it affects industries and individuals, and how to track and use it in practical, real-world decisions.

Copper Price Explained in Plain English

At its core, the copper price is simply the market value of refined copper, usually quoted per pound or per metric ton. But that simple number carries a surprising amount of information.

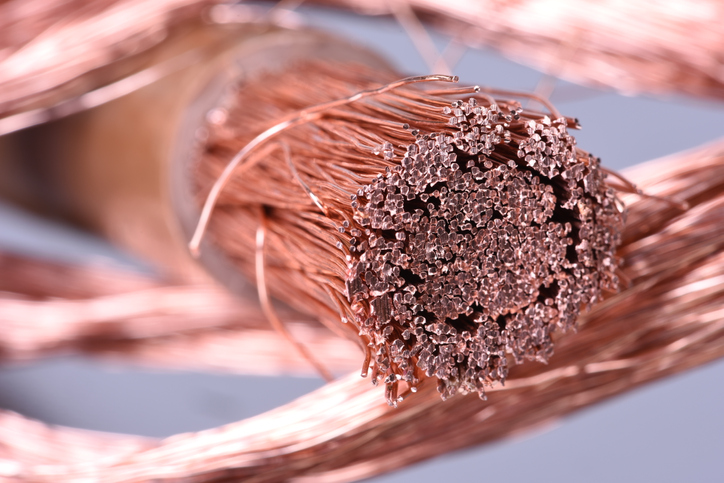

Think of copper as the nervous system of modern infrastructure. It runs through power lines, homes, cars, factories, smartphones, renewable energy systems, and data centers. Because it’s so widely used, changes in copper prices often reflect broader economic activity. That’s why copper is sometimes nicknamed “Dr. Copper”—the metal with a PhD in economics.

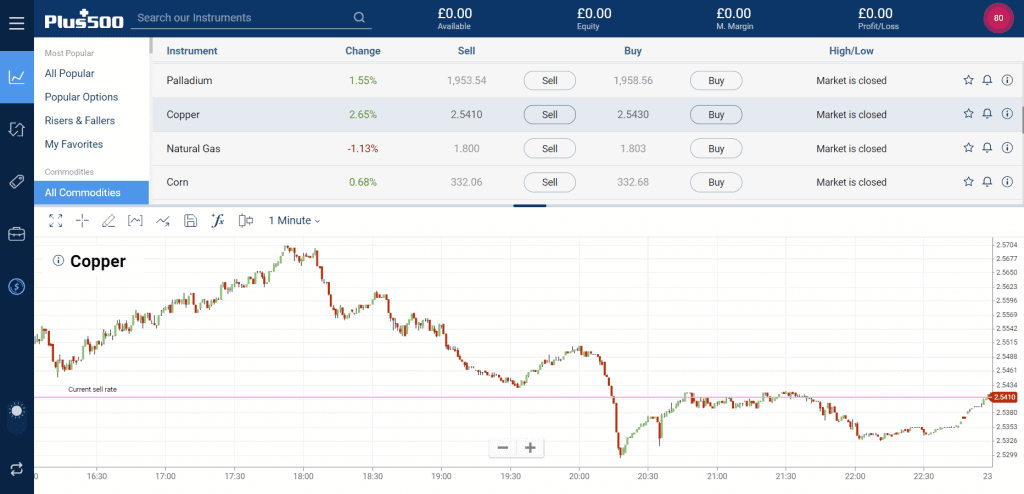

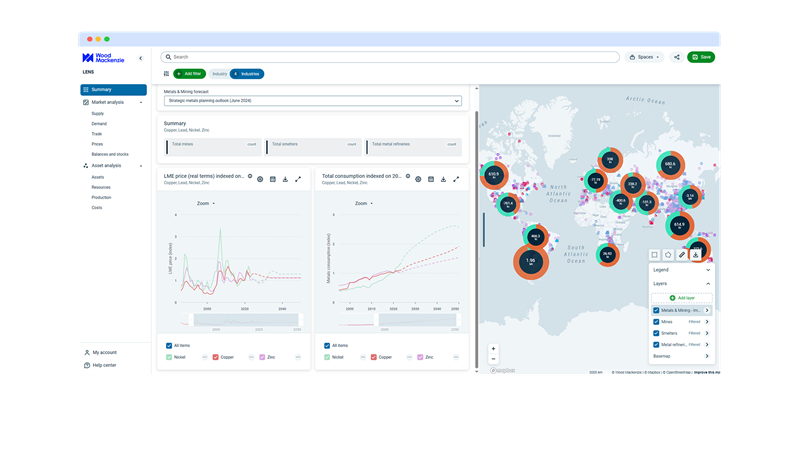

Copper prices are discovered in global markets, especially through futures contracts traded on exchanges like the London Metal Exchange (LME). These prices respond in real time to supply disruptions, demand surges, geopolitical news, and macroeconomic data.

For beginners, here’s an easy way to think about it:

- Strong global growth usually pushes copper prices higher.

- Economic slowdowns often drag copper prices lower.

- Supply shocks, like mine strikes or export bans, can send prices sharply upward.

- Technological shifts, such as electric vehicles or renewable energy expansion, create long-term demand pressure.

So when you look at the copper price, you’re not just seeing a metal—you’re seeing a snapshot of the global economy.

Why Copper Prices Matter More Than Most People Realize

Copper prices matter because they ripple outward. A change in copper price doesn’t stay confined to commodity charts; it flows into construction costs, manufacturing margins, energy projects, and even consumer prices.

For governments and economists, copper price trends help signal where the economy may be heading. Rising prices often suggest expanding infrastructure and industrial activity. Falling prices can hint at slowing growth or tightening financial conditions.

For businesses, copper prices directly affect budgets and profitability. Electrical contractors, appliance manufacturers, automakers, and renewable energy companies all feel copper price changes almost immediately. Even small swings can add up when you’re buying tons of material.

For individuals, copper prices influence:

- Home renovation costs (wiring, plumbing)

- Vehicle prices (especially EVs)

- Utility infrastructure investments

- Investment portfolios linked to commodities or mining stocks

Understanding copper price movements gives you context. Instead of reacting emotionally to headlines, you can interpret what’s actually happening under the surface.

Key Factors That Drive the Copper Price

Copper prices don’t move randomly. They respond to a consistent set of forces that interact in sometimes unpredictable ways.

Global Supply Dynamics

Copper supply is relatively concentrated. A handful of countries dominate production, and mining projects take years—sometimes decades—to develop. When supply is disrupted by labor strikes, environmental regulations, political instability, or weather events, prices can spike quickly.

Another factor is declining ore grades. Many major mines are producing lower concentrations of copper than they did years ago, which increases costs and limits how fast supply can grow.

Demand from Major Economies

China plays an outsized role in copper pricing. Its construction sector, manufacturing base, and infrastructure spending heavily influence global demand. When China stimulates its economy, copper prices often respond upward.

Other demand drivers include:

- U.S. infrastructure investment

- European industrial output

- Global electrification and renewable energy projects

- Electric vehicle production

Energy Transition and Technology

Copper is essential for electrification. Electric vehicles use significantly more copper than traditional cars. Solar panels, wind turbines, and grid upgrades all rely heavily on copper wiring.

This long-term structural demand has added a new layer to copper price forecasting. It’s no longer just about construction cycles—it’s also about how fast the world transitions to cleaner energy.

Currency and Macroeconomic Forces

Copper is priced in U.S. dollars, so dollar strength matters. A stronger dollar often pressures copper prices downward, while a weaker dollar tends to support higher prices.

Interest rates, inflation expectations, and global liquidity also influence investor appetite for commodities, including copper.

Benefits and Real-World Use Cases of Tracking Copper Prices

Tracking copper prices isn’t just for professional traders. There are practical benefits for many different people.

For investors, copper prices help:

- Identify economic turning points

- Evaluate mining stocks and ETFs

- Diversify portfolios beyond equities and bonds

For business owners and procurement teams, copper price awareness helps:

- Lock in contracts at favorable prices

- Plan budgets more accurately

- Decide when to hedge future purchases

For homeowners and contractors, copper prices influence:

- Timing of renovation projects

- Material cost estimates

- Contractor bids and pricing transparency

For students and analysts, copper prices provide:

- A real-world economic indicator

- Case studies in supply-demand dynamics

- Insight into global trade relationships

In short, copper prices act like a bridge between abstract economic theory and tangible, everyday decisions.

4

A Step-by-Step Guide to Using Copper Prices Effectively

Understanding copper prices is one thing. Using them effectively is another. Here’s a practical, step-by-step approach.

Step 1: Know Which Copper Price You’re Looking At

Copper prices vary by:

- Spot price

- Futures price (near-term vs long-dated)

- Physical market premiums

- Regional differences

Always confirm the unit (per pound or per metric ton) and the source.

Step 2: Match the Price to Your Goal

If you’re investing, futures prices and long-term trends matter most. If you’re buying materials, local physical prices and premiums are more relevant.

Step 3: Watch the Drivers, Not Just the Number

Instead of obsessing over daily price moves, track:

- Inventory levels

- Mining news

- Infrastructure spending plans

- EV and renewable energy trends

Step 4: Use Simple Technical and Fundamental Signals

You don’t need advanced models. Basic tools like moving averages, trendlines, and supply-demand news already put you ahead of most casual observers.

Step 5: Make Decisions, Not Predictions

The goal isn’t to predict copper prices perfectly. It’s to make better decisions with the information available—whether that’s timing a purchase, adjusting a budget, or rebalancing an investment.

Tools, Comparisons, and Practical Recommendations

There’s no shortage of tools for tracking copper prices, but not all are equally useful.

Free tools are great for beginners. Financial news sites, commodity dashboards, and exchange websites offer delayed prices and basic charts. They’re ideal for understanding trends and context.

Paid platforms provide:

- Real-time data

- Advanced charting

- Historical datasets

- Alerts and analytics

For most users, a mix works best. Start with free tools to build familiarity. Upgrade only if copper prices directly affect your income or investment decisions.

When comparing tools, focus on:

- Data reliability

- Ease of use

- Transparency in pricing

- Educational resources

Avoid overcomplicated platforms that drown you in indicators without improving decision-making.

4

Common Copper Price Mistakes and How to Avoid Them

One of the biggest mistakes people make is treating copper prices like a stock ticker—reacting emotionally to every move. Copper is cyclical and volatile. Short-term noise is normal.

Another common error is ignoring the difference between futures prices and real-world physical costs. Local premiums, transportation, and availability matter, especially for businesses.

Many beginners also overestimate their ability to time the market. Trying to buy at the exact bottom or sell at the exact top usually leads to frustration.

To avoid these mistakes:

- Focus on trends, not ticks

- Match the price data to your real-world needs

- Build margin for error into budgets and strategies

- Stay informed, but don’t overtrade

Experience teaches that patience and context matter more than perfect timing.

Conclusion

The copper price is far more than a number on a chart. It’s a living signal of economic activity, technological change, and global trade. Whether you’re investing, running a business, studying markets, or simply trying to understand the world a little better, copper prices offer valuable insight.

By understanding what drives copper prices, how to track them intelligently, and how to apply that knowledge in real life, you move from reacting to headlines to making informed decisions. That shift—quiet, steady, and practical—is where real value lies.

If you’ve found this guide useful, consider bookmarking it, sharing it, or exploring related market topics. Copper may be old, but its story is more relevant than ever.

FAQs

What is the current copper price based on?

Copper prices are based on global supply and demand, traded primarily through futures contracts on major exchanges.

Does copper price affect everyday consumers?

Yes. It influences construction costs, vehicle prices, energy infrastructure, and household wiring expenses.

Is copper a good investment?

Copper can be a useful diversification asset, but it’s cyclical and volatile, so it suits informed, long-term strategies.

How often does the copper price change?

Copper prices change constantly during market hours as new information enters the market.

Why is copper called an economic indicator?

Because copper is used across construction, manufacturing, and energy, its price often reflects overall economic health.

Michael Grant is a business writer with professional experience in small-business consulting and online entrepreneurship. Over the past decade, he has helped brands improve their digital strategy, customer engagement, and revenue planning. Michael simplifies business concepts and gives readers practical insights they can use immediately.