Introduction

If you’ve ever looked at your sales numbers and thought, “We’re selling more, so why doesn’t it feel like we’re making more money?”—you’re already brushing up against the idea of contribution margin. This single metric quietly explains why some fast-growing businesses struggle to stay afloat while others scale smoothly and profitably.

Contribution margin matters because it strips away the noise. It doesn’t get distracted by rent, salaries, or software subscriptions. Instead, it answers a deceptively simple but powerful question: How much does each sale actually contribute toward covering fixed costs and generating profit?

In this guide, you’ll learn what contribution margin really means, how to calculate it correctly, and—more importantly—how to use it in real business decisions. We’ll walk through relatable examples, common mistakes, practical tools, and step-by-step methods you can apply whether you’re running an online store, a SaaS company, a restaurant, or a service-based business.

By the end, you won’t just understand contribution margin—you’ll know how to think with it.

Topic Explanation: What Contribution Margin Really Means (Without the Jargon)

At its core, contribution margin is the amount of revenue left after you subtract variable costs. These are costs that change with each unit you sell—things like raw materials, transaction fees, shipping, or hourly labor directly tied to production.

Think of your business like a bucket with a hole in the bottom. Revenue pours in from the top. Variable costs leak out immediately. What remains—the contribution margin—is the water that can rise high enough to cover fixed costs like rent, salaries, insurance, and marketing software. Once those fixed costs are covered, every extra dollar of contribution margin becomes profit.

The basic formula looks like this:

Revenue − Variable Costs = Contribution Margin

You can express it in two common ways:

- Contribution margin (dollars)

- Contribution margin ratio (percentage of revenue)

For example, if you sell a product for $100 and variable costs are $60, your contribution margin is $40, or 40%. That means every sale contributes $40 toward fixed expenses and profit.

What makes contribution margin so powerful is its clarity. Gross profit can blur lines by mixing fixed and variable costs. Net profit comes too late in the story. Contribution margin sits in the sweet spot—early enough to guide decisions, but detailed enough to reveal what’s actually driving profitability.

Benefits & Use Cases: Why Contribution Margin Changes How You Run a Business

Understanding contribution margin isn’t just for accountants or finance teams. It’s a decision-making tool that shows up in surprisingly practical ways.

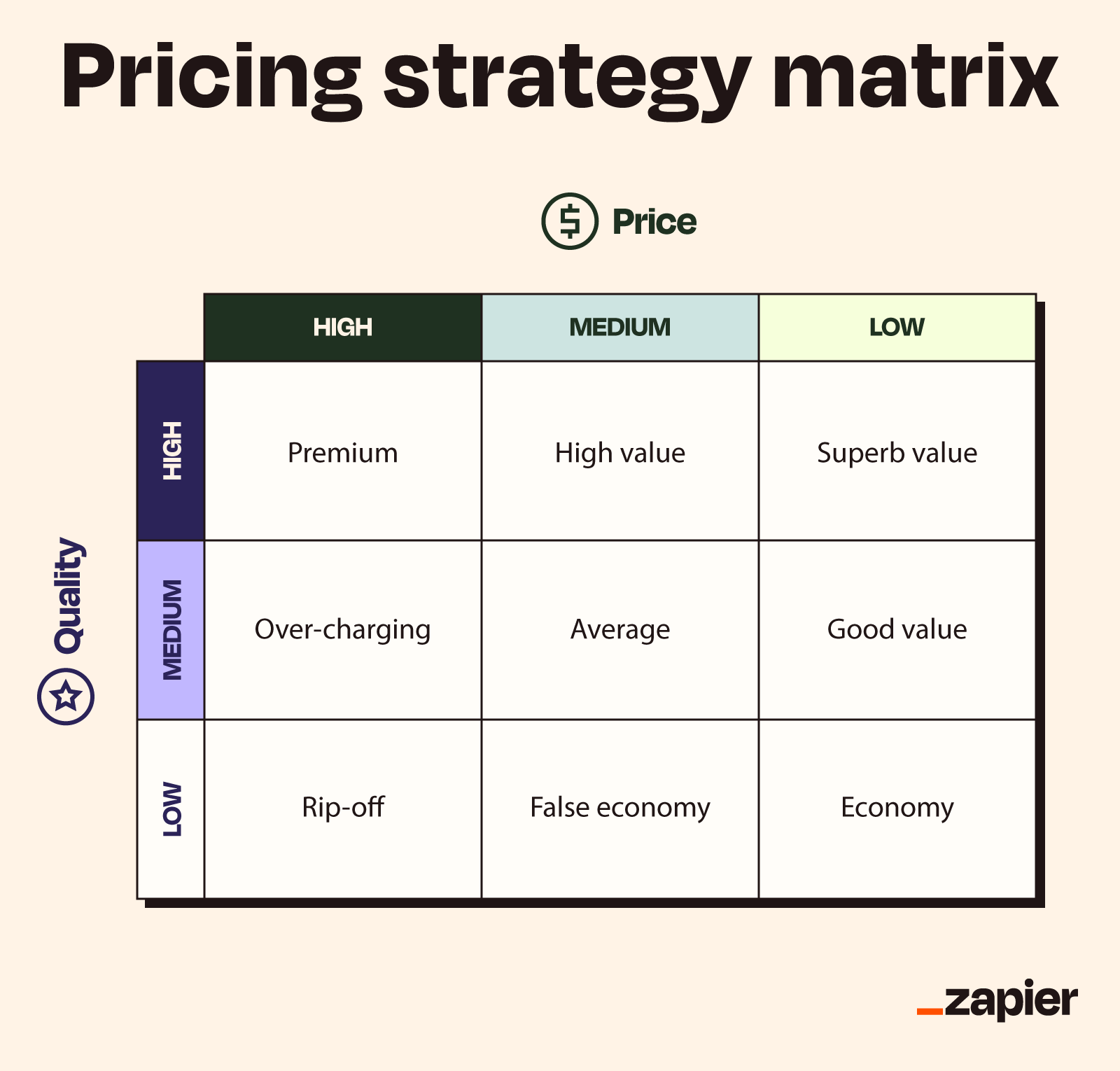

First, it helps you decide what to sell more of. Not all revenue is equal. Two products might generate the same sales dollars, but if one has a 70% contribution margin and the other sits at 25%, pushing the wrong product can quietly drain your business.

Second, it informs pricing decisions. When you know your contribution margin, discounts stop being guesswork. You can instantly see how much room you have before a promotion starts hurting instead of helping.

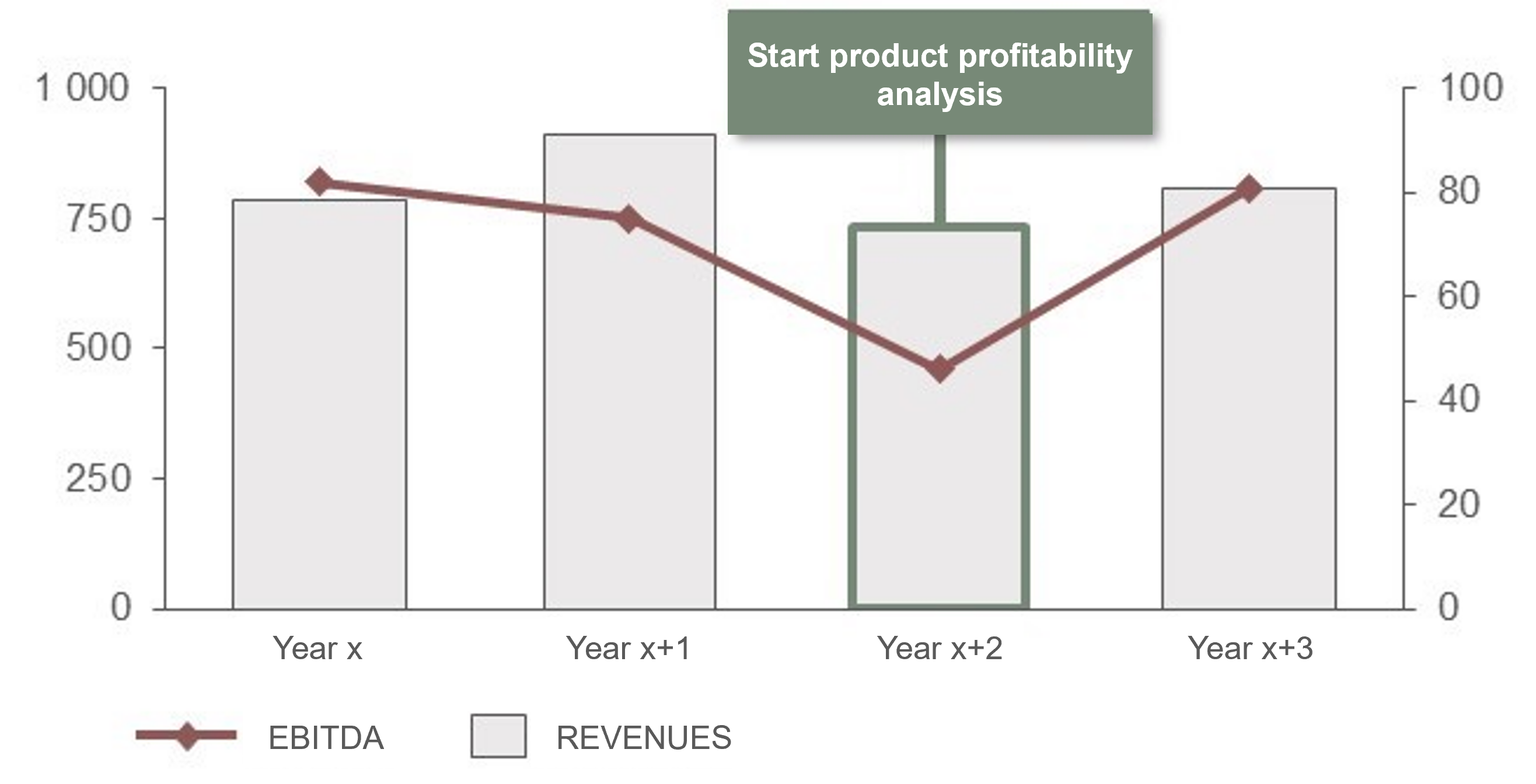

Third, contribution margin plays a critical role in break-even analysis. By knowing how much each sale contributes, you can calculate exactly how many units you need to sell to cover fixed costs—and what happens if those costs increase.

Real-world use cases include:

- Retailers deciding which SKUs deserve premium shelf space

- SaaS founders choosing between monthly and annual pricing

- Agencies evaluating whether a client is worth keeping

- Manufacturers deciding whether to outsource or produce in-house

In short, contribution margin turns “Are we busy?” into “Are we profitable for the right reasons?”

Step-by-Step Guide: How to Calculate Contribution Margin the Right Way

Calculating contribution margin is straightforward, but accuracy matters. Small classification errors can lead to big strategic mistakes.

Start by clearly separating variable and fixed costs. Variable costs change with output. Fixed costs don’t—at least in the short term. This distinction is essential.

Step one is identifying revenue. Use net sales, not gross. That means subtracting refunds, discounts, and allowances.

Step two is listing variable costs. Common examples include:

- Cost of goods sold (materials, components)

- Payment processing fees

- Shipping and packaging

- Sales commissions

- Hourly labor directly tied to production

Step three is subtracting variable costs from revenue. The result is your contribution margin in dollars.

Step four is calculating the ratio:

Contribution Margin ÷ Revenue = Contribution Margin Ratio

Let’s say:

- Revenue: $50,000

- Variable costs: $30,000

Your contribution margin is $20,000, and your ratio is 40%.

Best practices include reviewing costs quarterly, stress-testing assumptions, and calculating contribution margin by product, service, or customer segment. The more granular you go, the more useful the insights become.

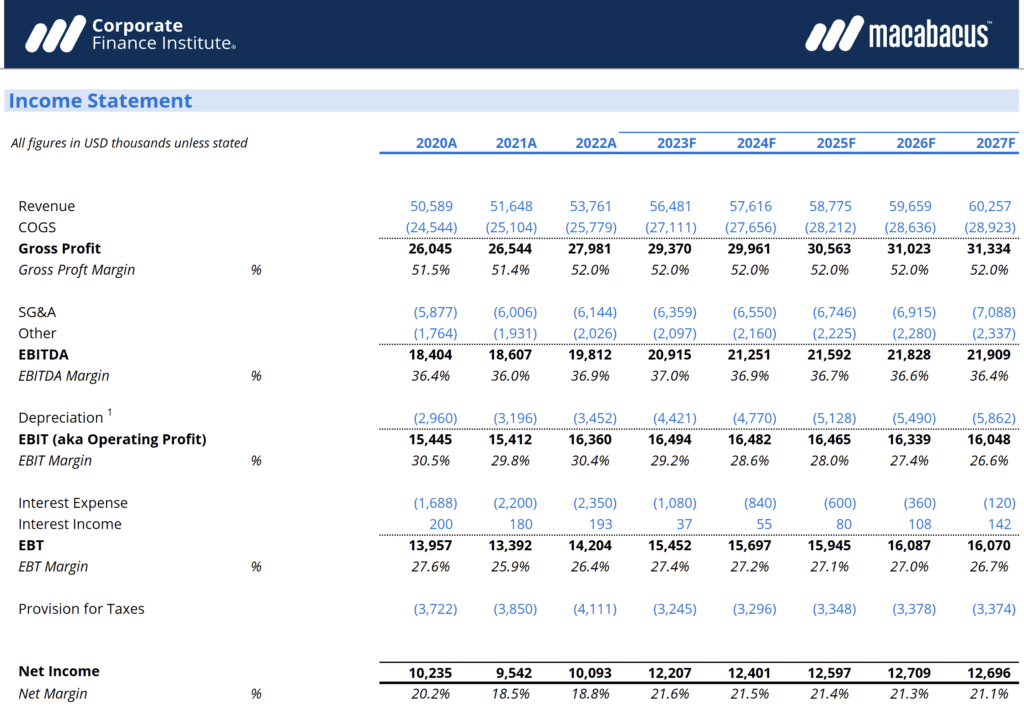

Contribution Margin vs Gross Margin: A Common (and Costly) Confusion

Many business owners use contribution margin and gross margin interchangeably—and that’s where trouble starts.

Gross margin subtracts cost of goods sold, which often includes fixed manufacturing overhead. Contribution margin subtracts only variable costs. That difference matters.

Gross margin is great for external reporting and high-level analysis. Contribution margin is better for internal decision-making. It’s the metric you use when deciding whether to:

- Run a limited-time discount

- Add a new sales channel

- Accept a custom order

- Scale advertising spend

If gross margin tells you how efficient production is, contribution margin tells you how each sale fuels the business engine.

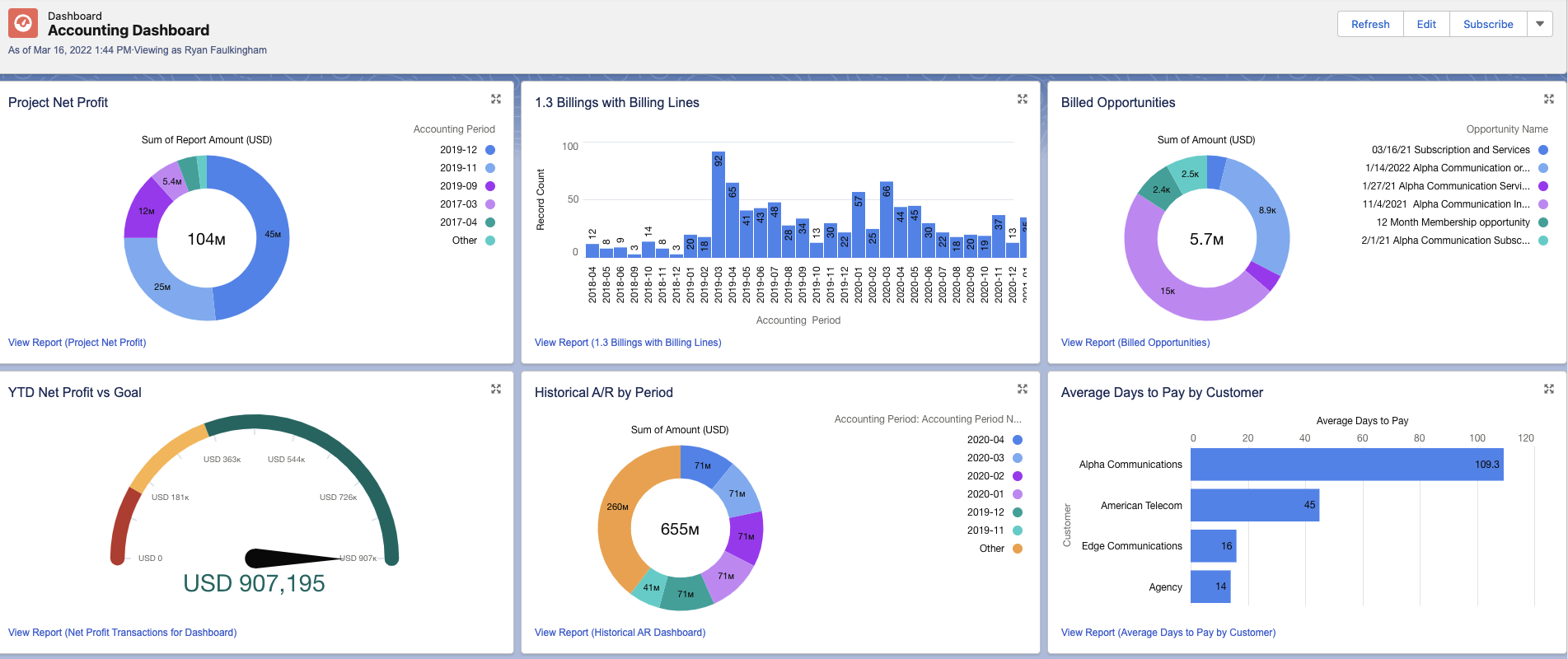

Tools, Comparisons & Recommendations

You don’t need complex software to work with contribution margin—but the right tools can save time and reduce errors.

Spreadsheets are often the starting point. A simple Excel or Google Sheets model lets you test scenarios quickly. They’re free, flexible, and transparent. The downside is manual upkeep and higher error risk as complexity grows.

Accounting software like QuickBooks or Xero can automate data collection. These tools shine when integrated with sales platforms and payment processors. However, they often require customization to isolate variable costs properly.

Advanced options include financial planning and analysis (FP&A) tools that model contribution margin by product, channel, or cohort. These are ideal for growing businesses with multiple revenue streams.

When choosing tools, prioritize:

- Clear cost categorization

- Scenario modeling

- Product-level reporting

- Ease of updates

The best tool is the one you’ll actually keep up to date.

Common Mistakes & Fixes (and How to Avoid Them)

One of the most common mistakes is misclassifying costs. Marketing software, office rent, and salaried staff are often incorrectly treated as variable. This inflates contribution margin and leads to risky decisions.

Another frequent error is averaging margins across products. Averages hide extremes. A low-margin product can quietly consume resources while a high-margin one carries the business.

Ignoring capacity constraints is another trap. Contribution margin assumes you can scale indefinitely, but real-world limits like labor, inventory, or ad inventory can cap growth.

To fix these issues:

- Review cost classifications regularly

- Calculate margins at the most granular level possible

- Pair contribution margin analysis with operational constraints

- Revisit assumptions when prices or suppliers change

Think of contribution margin as a living metric, not a one-time calculation.

Using Contribution Margin for Smarter Pricing and Growth Decisions

Contribution margin becomes truly powerful when you use it to guide growth.

For pricing, it tells you how much flexibility you have. If your contribution margin is strong, you can afford to test promotions or enter competitive markets. If it’s thin, even small discounts can be dangerous.

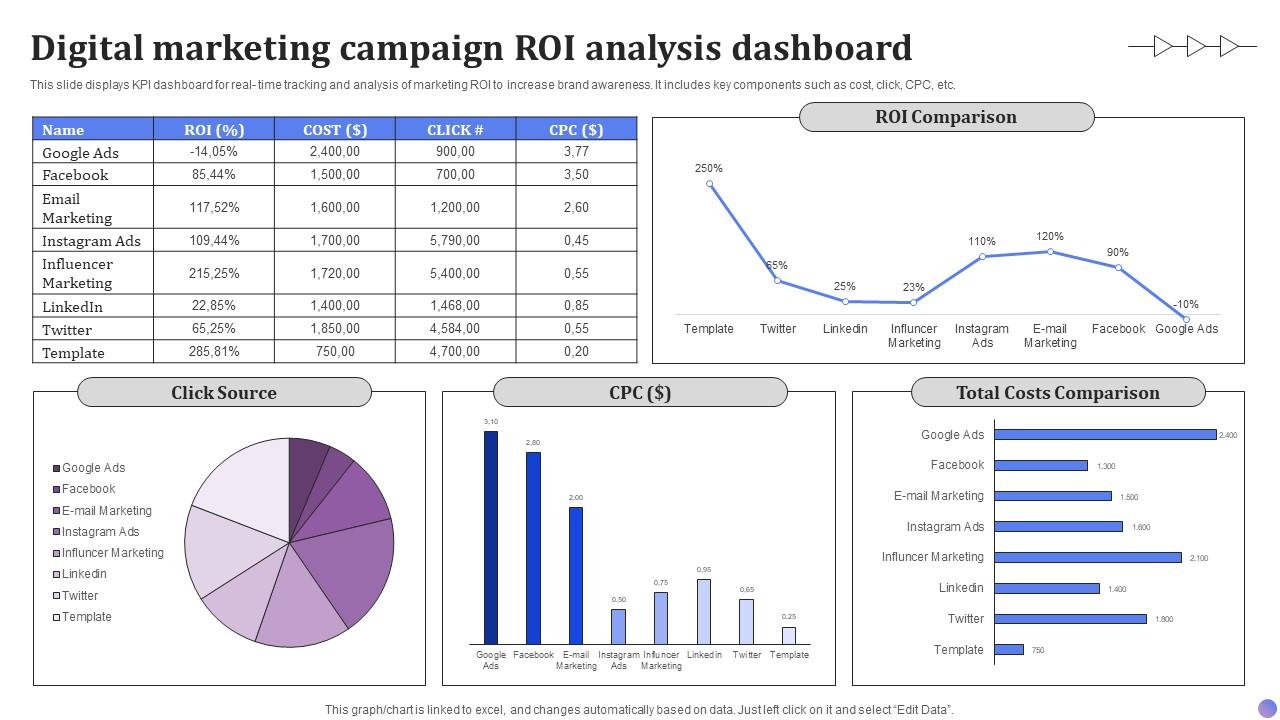

For marketing, contribution margin helps you evaluate return on ad spend more realistically. Instead of asking “Did we make sales?” you ask “Did those sales contribute enough to justify the spend?”

For product strategy, it highlights where to invest. High-margin offerings deserve more attention, optimization, and promotion.

This mindset shifts growth from “sell more” to “sell smarter.”

Contribution Margin and Break-Even Analysis

Break-even analysis is where contribution margin really shines. Once you know your fixed costs and contribution margin per unit, you can calculate exactly how many sales it takes to cover expenses.

The formula is simple:

Fixed Costs ÷ Contribution Margin per Unit = Break-Even Volume

If your fixed costs are $20,000 per month and your contribution margin per unit is $40, you need 500 sales to break even.

This clarity helps with forecasting, budgeting, and stress-testing scenarios like price increases or cost spikes.

Conclusion

Contribution margin isn’t flashy, but it’s foundational. It reveals the true economics of your business, guiding smarter pricing, better product decisions, and sustainable growth. When you understand how much each sale contributes, you stop guessing and start managing with confidence.

Whether you’re just starting out or scaling fast, mastering contribution margin gives you a clearer path to profitability. Take the time to calculate it accurately, review it regularly, and use it as a lens for every major decision. Your future self—and your bottom line—will thank you.

FAQs

What is contribution margin in simple terms?

It’s the money left from sales after paying variable costs, used to cover fixed costs and generate profit.

How is contribution margin different from profit?

Contribution margin comes before fixed costs, while profit is what remains after all expenses.

Why is contribution margin important for pricing?

It shows how much room you have to discount or invest while staying profitable.

Can contribution margin be negative?

Yes, if variable costs exceed revenue, indicating a fundamentally unprofitable offering.

What is a good contribution margin ratio?

It depends on the industry, but higher ratios generally provide more flexibility and resilience.

Michael Grant is a business writer with professional experience in small-business consulting and online entrepreneurship. Over the past decade, he has helped brands improve their digital strategy, customer engagement, and revenue planning. Michael simplifies business concepts and gives readers practical insights they can use immediately.