If you’ve followed the markets even casually over the past few years, you’ve probably noticed something interesting. Artificial intelligence went from a futuristic buzzword to a boardroom priority almost overnight. One earnings call after another mentions “AI integration.” One product launch after another promises “AI-powered” everything. And quietly, consistently, money has been flowing into stock in AI at a pace we haven’t seen since the early days of the internet.

This article is for you if you’ve asked any of these questions recently:

Is investing in AI stocks already too late?

Which AI companies are actually making money versus just hyping the future?

How do I invest in stock in AI without gambling on speculation?

Whether you’re a beginner investor trying to understand what AI means for your portfolio or an experienced market participant refining your strategy, this guide is designed to give you clarity. Not theory. Not hype. Real-world context, practical frameworks, and grounded insights drawn from how AI businesses actually operate and grow.

By the end, you’ll understand what stock in AI really represents, where the biggest opportunities lie, how professionals evaluate AI-related companies, and how to avoid the mistakes that quietly destroy returns.

What Does “Stock in AI” Really Mean? A Clear Explanation from Beginner to Expert

At its simplest, stock in AI refers to shares in companies that either develop artificial intelligence technology or rely on AI as a core driver of revenue and competitive advantage. But that definition alone hides a lot of nuance, and nuance is where smart investing lives.

Think of AI like electricity in the early 1900s. Some companies built power plants. Others made appliances. Still others used electricity better than competitors and dominated their industries as a result. Stock in AI follows the same layered structure.

At the foundation are companies building the infrastructure. These include firms designing advanced semiconductors, data centers, and cloud platforms that make large-scale AI possible. Above them are software companies creating machine learning models, AI platforms, and tools businesses actually use. Then there are adopters: companies in healthcare, finance, retail, and manufacturing using AI to cut costs, increase speed, and unlock entirely new services.

For beginners, it’s helpful to start with the idea that you’re not investing in “AI” as a concept. You’re investing in businesses that monetize AI in specific, measurable ways. For experienced investors, the focus shifts toward execution: margins, scalability, regulatory exposure, and durability of advantage.

The key transition from beginner to expert thinking is understanding that not every company mentioning AI deserves to be considered a serious AI stock. True stock in AI demonstrates at least one of three things: proprietary technology, structural dependency on AI for revenue growth, or defensible positioning in the AI supply chain.

Why Stock in AI Matters Right Now More Than Ever

Timing matters in markets, and AI is at a unique moment. We’re no longer in the “research-only” phase, but we’re also not at saturation. That combination creates rare asymmetry.

Several forces are converging at once. Computing power has reached a point where training massive models is commercially viable. Data availability has exploded across industries. And businesses are under pressure to automate, personalize, and optimize faster than human teams alone can manage.

From an investment perspective, this means AI is shifting from experimental budgets to operational spending. When AI moves into operating expenses, revenue becomes recurring. Recurring revenue is what markets reward most aggressively.

There’s also a macro dimension. Labor shortages, rising costs, and global competition are pushing companies to adopt AI whether they want to or not. That creates demand that is structural, not cyclical. Stock in AI benefits from this pressure because AI is increasingly a necessity rather than a luxury.

This moment resembles the early cloud computing era. Early investors who focused on companies with real usage, not just compelling demos, were rewarded handsomely. The same pattern is unfolding now.

The Benefits and Real-World Use Cases of Stock in AI

The biggest mistake people make when evaluating stock in AI is thinking the value comes from novelty. In reality, the value comes from outcomes. Time saved. Costs reduced. Revenue unlocked. Risks managed.

In healthcare, AI models are improving diagnostic accuracy and reducing administrative overhead. Companies integrating AI into imaging, drug discovery, and patient management are shortening timelines that used to take years.

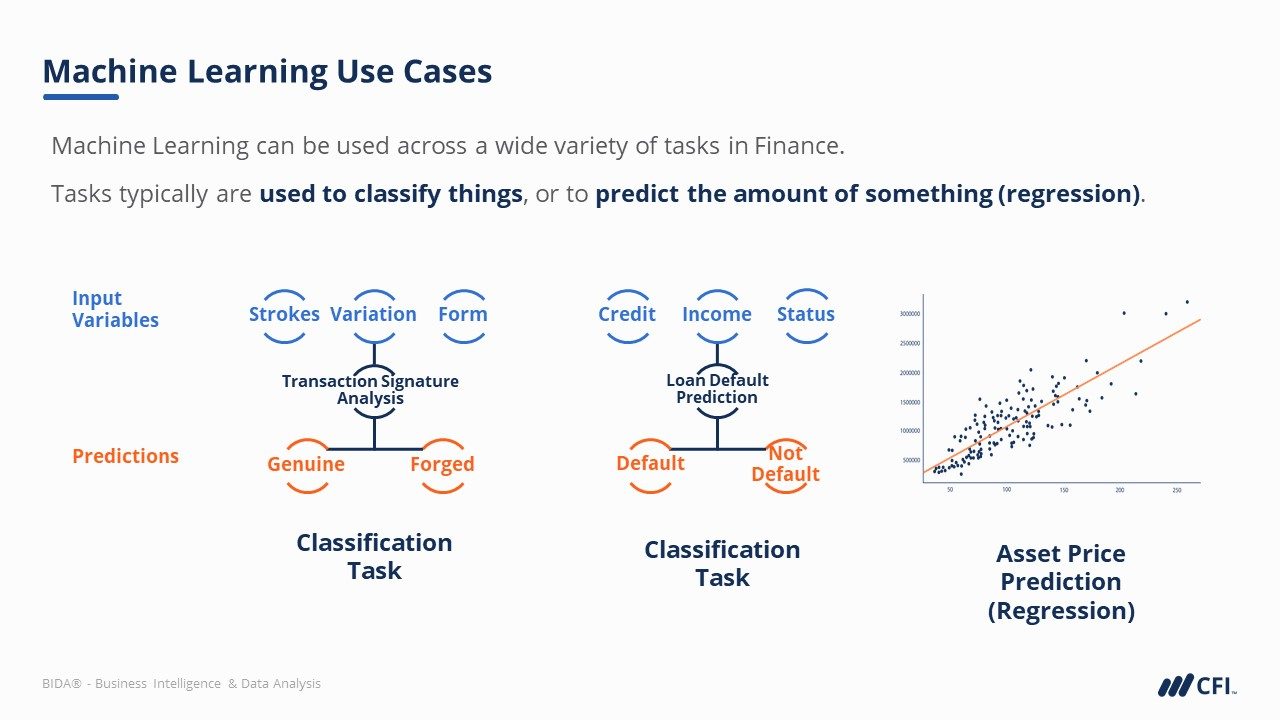

In finance, AI is embedded in fraud detection, algorithmic trading, credit scoring, and customer support. Before AI, these systems relied on static rules. After AI, they adapt in real time.

Retail and e-commerce companies use AI to personalize recommendations, forecast demand, and optimize logistics. The “before” state involved guesswork and overstock. The “after” state is precision and speed.

Manufacturing benefits through predictive maintenance and quality control. Instead of reacting to failures, AI anticipates them. That single shift saves millions annually for large operations.

For investors, the benefit is exposure to businesses whose efficiency compounds over time. AI-driven advantages often widen as systems learn, creating moats that are difficult for competitors to replicate.

A Step-by-Step Practical Framework for Investing in Stock in AI

Successful AI investing isn’t about chasing headlines. It’s about process. The following framework mirrors how professional investors evaluate AI exposure.

First, identify where the AI value sits. Is the company selling AI directly, enabling others to build AI, or using AI internally to outperform competitors? Each category carries different risk and reward profiles.

Second, evaluate monetization. Ask how AI translates into revenue. Subscription models, usage-based pricing, and enterprise contracts tend to be more durable than one-off licensing.

Third, assess data advantage. AI models improve with data. Companies with proprietary or hard-to-replicate data sources have a structural edge that shows up in long-term margins.

Fourth, examine scalability. AI businesses often have high upfront costs but low marginal costs. The faster a company scales revenue relative to compute expense, the stronger the investment case.

Fifth, consider risk. Regulatory scrutiny, ethical concerns, and dependence on third-party infrastructure all matter. Ignoring these factors is how promising AI stocks turn into painful lessons.

Finally, position sizing matters. Even the best stock in AI should be part of a diversified portfolio. Concentration magnifies both insight and error.

Tools, Platforms, and Expert Stock in AI Recommendations

When people ask which AI stocks to buy, what they’re often really asking is which segment of the AI ecosystem they should focus on.

Infrastructure leaders like NVIDIA dominate because advanced AI models require specialized hardware. Their advantage lies in deep engineering expertise and ecosystem lock-in.

Platform companies such as Microsoft benefit from embedding AI into cloud services used by millions of businesses. AI becomes a value multiplier rather than a standalone product.

Software and model developers, including firms like Alphabet, leverage massive datasets and research capabilities to push AI forward while monetizing through ads, tools, and services.

For beginners, ETFs focused on AI and automation provide diversified exposure with lower company-specific risk. Advanced investors may prefer direct stock selection to target higher upside.

Free tools like earnings transcripts and product demos help evaluate narrative versus execution. Paid platforms such as professional research terminals add depth but are not mandatory for disciplined analysis.

Common Mistakes Investors Make with Stock in AI and How to Avoid Them

The most common mistake is confusing innovation with profitability. Many AI companies have impressive technology but weak business models. Technology alone doesn’t create shareholder returns.

Another frequent error is overpaying during hype cycles. AI narratives can push valuations far beyond fundamentals. Patience and valuation discipline matter more than excitement.

Some investors ignore dependency risk. A company relying heavily on another firm’s cloud or hardware stack may face margin pressure if terms change.

There’s also the mistake of thinking AI adoption is instant. Integration takes time. Revenue often lags headlines by quarters or years. Impatience leads to selling too early.

Finally, many underestimate regulation. AI touching healthcare, finance, or personal data will face scrutiny. Companies proactively managing compliance tend to outperform long term.

The fix is simple but not easy: focus on execution, not promises; cash flow, not press releases; and strategy, not speculation.

Conclusion: The Long-Term Case for Stock in AI

Stock in AI isn’t a trend you trade and forget. It’s a structural shift reshaping how businesses operate and compete. The real opportunity lies not in predicting the next viral AI tool, but in identifying companies that quietly, consistently turn AI into durable economic value.

If you approach AI investing with curiosity, discipline, and patience, you position yourself alongside some of the most powerful forces in modern business. The future of AI will not be built by hype alone. It will be built by companies that execute, adapt, and scale responsibly.

Your next step could be as simple as analyzing one AI-related company through the framework you’ve learned here. Start there. Insight compounds just like returns.

FAQs

What is the safest way to invest in stock in AI?

Diversified exposure through AI-focused ETFs or established technology leaders reduces company-specific risk.

Is it too late to invest in AI stocks?

AI adoption is still in early commercial stages across many industries, suggesting long-term growth potential remains.

Do AI stocks pay dividends?

Most AI-focused companies reinvest profits into growth, though some mature firms do offer dividends.

How volatile are AI stocks?

AI stocks can be volatile due to valuation sensitivity and news cycles, making long-term perspective important.

What industries benefit most from AI investing?

Technology, healthcare, finance, manufacturing, and retail are among the biggest beneficiaries.

Adrian Cole is a technology researcher and AI content specialist with more than seven years of experience studying automation, machine learning models, and digital innovation. He has worked with multiple tech startups as a consultant, helping them adopt smarter tools and build data-driven systems. Adrian writes simple, clear, and practical explanations of complex tech topics so readers can easily understand the future of AI.